There are a fair number of economists who argue that Government makes bad decisions on how to spend money and that the solution is to leave the money in private hands and the economy will do better.

This is in fact the heart of trickle down or supply side economics.

The one thing though is that the Government doesn't hold on to money very long, in fact everything that comes in goes out and more.

A lot of this involves redistributing the wealth in collecting taxes from people who obviously have something and giving benefits and services to some people who have nothing.

Now lets be clear, the social engineering type of programs are by no means the major portion of the federal budget.

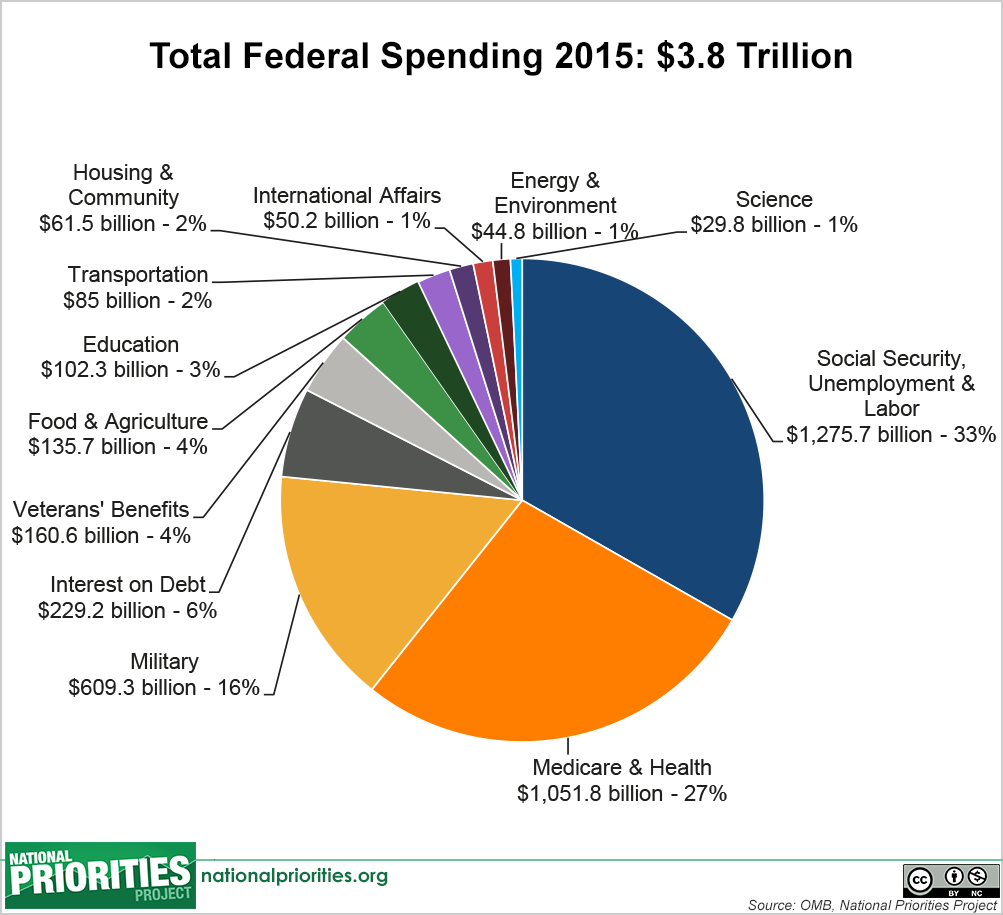

A chart of how the budget was spent in 2015 shows the distribution but the three biggest areas include Social Security, Medicare and Military.

The first two are going to grow as our population continues to age and we also seem ready to increase military spending.

That's over 75% of our spending and if you consider the interest on the debt and Veteran's benefits we are over 85%.

Now this is a world of big numbers so even the small pieces represent billions of dollars, but its still hard to cut them enough to balance the budget.

So despite any denials the only way spending cuts can eliminate the deficit is if we cut the first three areas.

Since that is both political suicide and morally wrong, the only real alternative is to increase tax revenues.

So how would you cut taxes and fund these programs?

Well if the economy booms, tax revenues increase. Companies allowed to keep more profits are able to invest and grow, creating jobs. Putting people to work improves their incomes and promotes further growth.

Supply side as simple as it can be depicted.

Of course if the investment is used to automate the plant using foreign technology and parts the jobs are somewhere else.

We don't have a large pool of unemployed in this country we may have a number of underemployed, but they aren't likely to snag high paying tech jobs that may be created.

I got a bit off of the topic of tax reform but the reason is that I think the reform has to address how we pay our bills by collecting enough taxes. The burden on our citizens and businesses has to be fair so I'm strongly in favor of what is called a value added tax, that taxes products sold here no matter where they originate.

More about value added to come.

No comments:

Post a Comment